🔄 Top up loans without starting from scratch

Hello there! 👋 It’s July. New month, new quarter, and a new half year. A good point to step back, refocus, and pick up the pace. Whether the last quarter felt like a mad dash or a lazy stroll, the next six months will decide how the year closes. Maybe you need to tighten your […]

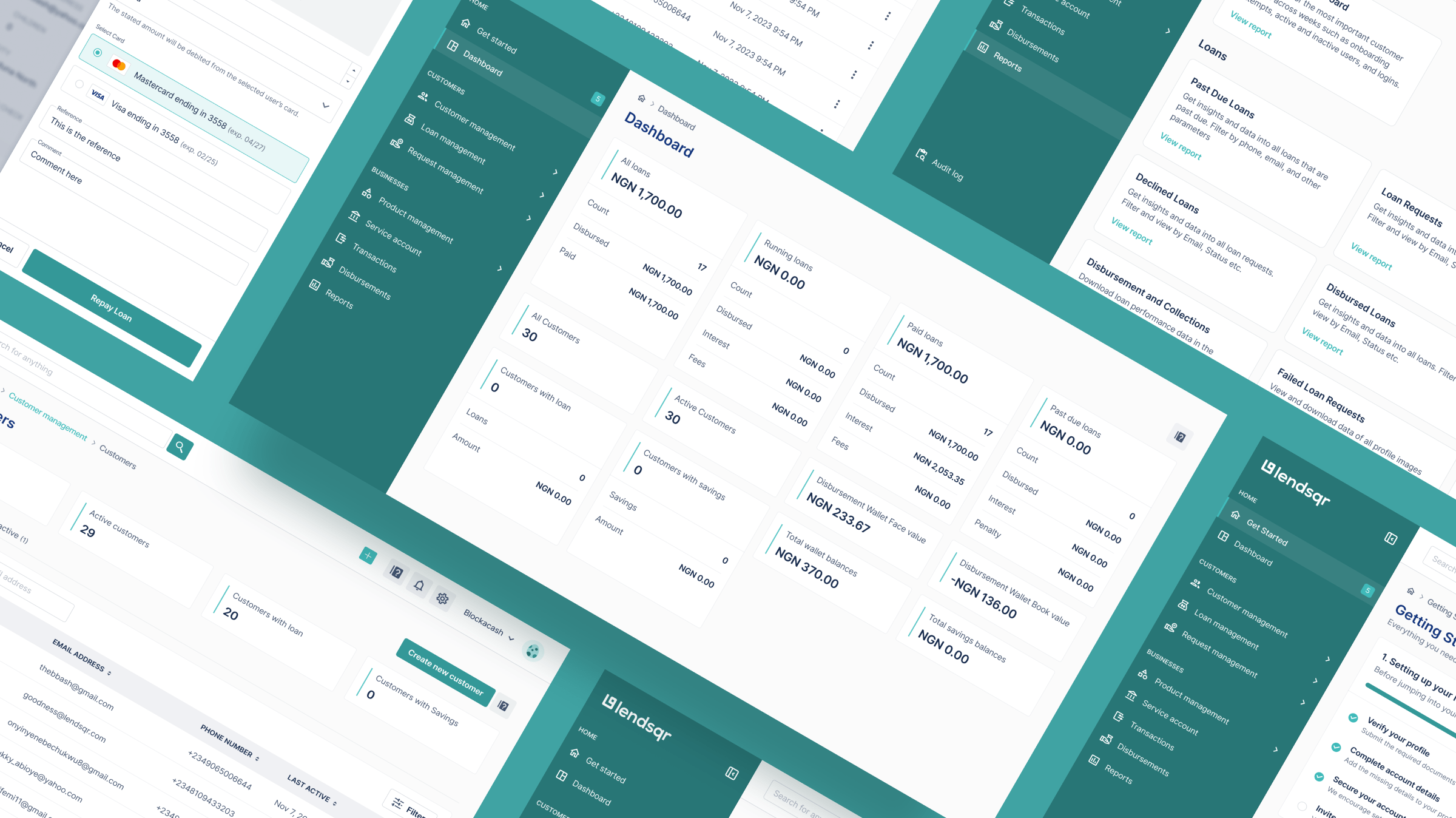

Loandisk vs. LendFusion: Which loan management software is better for you?

The gap between fast-growing lenders and those stuck comes down to software. If you're running a growing operation, this guide will help you figure out which system actually fits your business, your team, and your future as a lender.

How debit order works in South Africa

This report provides an in-depth analysis of the debit order ecosystem in South Africa from 2019-2024, covering its regulatory framework, operational mechanics, key players, adoption trends, infrastructure, challenges, and future innovations.

How debit order works in Botswana

This report provides an in-depth analysis of the debit order ecosystem in Botswana from 2019-2024, covering its regulatory framework, operational mechanics, key players, adoption trends, infrastructure, challenges, and future innovations.

Lendsqr brings its lending technology to Liberia’s non-profits and DFIs

Lendsqr is empowering Liberia's development sector by offering its world-class lending software for free to non-profits and DFIs. Automate your loan cycles and scale your impact to reach the informal sector across Liberia with ease.

Lendsqr brings its lending technology to Botswana’s non-profits and DFIs

Lendsqr is transforming Botswana's development sector by offering its world-class lending software for free to non-profits and DFIs. Automate your loan cycles and scale your impact to reach the unbanked across Botswana effortlessly.

Lendsqr brings its lending technology to Rwanda’s non-profits and DFIs

Lendsqr is revolutionizing social impact in Rwanda by offering its world-class lending infrastructure for free to non-profits and DFIs. Organizations can now automate loan management and scale their credit programs to reach the unbanked with ease.

How to get a student loan in Liberia

Higher education in Liberia still demands more persistence than it should. This article is a working map for students in Liberia seeking for loan options.

LetsGo vs ExpressCredit: which is the best in Botswana

LetsGo and ExpressCredit are solving different problems for different people in Botswana. If you’ve ever found yourself unsure about where to borrow or you simply want to get smarter about your options, this article is for you.

Who regulates lending in South Africa?

This article unpacks the key regulators involved in South Africa’s lending sector, what each one does, and why their roles matter now more than ever.

We’re giving our lending tech away for free to non-profit and DFIs

If you’re a non-profit or development finance institution (DFI), it should be easier to run a lending program if you're already doing the hard part of reaching people most others won’t.